Latest News

GolfN Tees Up Play-to-Earn Golf Following $1.3M Pre-Seed Raise | EVM News

Chicago, United States, June 25th, 2024, Chainwire

GolfN is the first golf app to use the power of tokenization and digital collectibles to empower its members to earn rewards for playing and engaging with a physical sport.

GolfN, Inc., today announced the closure of its $1.3 million Pre-Seed funding round. The round saw participation by prominent blockchain investors, including leading personalities and projects in the Solana ecosystem – CitizenX, Fourth Revolution Capital (@DeFi_Dad), Nom (@TheOnlyNom), and Joe McCann (Asymmetric Financial) – among others. First off the tee in building a gamified Play-to-earn (P2E) mechanism for a physical sport, GolfN will offer a premium digital caddie app to rival current market incumbents and pair it with Web3 rewards.

“Despite its high cost of play, golf has hooked nearly 67 million people globally,” commented Jared Phillips, GolfN’s CEO and Co-Founder, “Currently, the more golfers play, the more they pay out. The free-to-use GolfN App will not only help users play better, but the more they play and engage, the more they will earn to play more and better golf.”

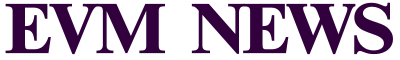

In March 2024, GolfN released its Genesis Collection of NFT Golf Clubs on the Solana network. The Clubs, which come in various rarities, are the keys to earn scaling rewards in the GolfN ecosystem. Hosted on Tensor Launchpad, one of the leading digital collectible marketplaces, the Mint sold out in under an hour.  The raise will be allocated to the development and scaling of the GolfN app, community, and ecosystem. The GolfN mobile application, due out in open beta later this year, will bring GolfN’s Web3 gamification layer to the real-world game of golf. While using the App as a digital caddie and social platform, players will be able to equip their digital collectible golf clubs to earn rewards during each round, track side games, and organize leagues with friends. For players who did not purchase GolfN’s digital collectible golf clubs during the mint, the company will offer monthly membership subscriptions for which rental NFT clubs will be made available by collectors.

The raise will be allocated to the development and scaling of the GolfN app, community, and ecosystem. The GolfN mobile application, due out in open beta later this year, will bring GolfN’s Web3 gamification layer to the real-world game of golf. While using the App as a digital caddie and social platform, players will be able to equip their digital collectible golf clubs to earn rewards during each round, track side games, and organize leagues with friends. For players who did not purchase GolfN’s digital collectible golf clubs during the mint, the company will offer monthly membership subscriptions for which rental NFT clubs will be made available by collectors.

About GolfN

GolfN is redesigning golf engagement for the decentralized digital era. With a focus on innovation, community, and sustainability, GolfN is dedicated to enriching the golfing experience for golf enthusiasts of all levels. In addition to minting the first digital collectibles for a real-world sport like Golf, GolfN is developing a gamified social caddie app for on-course play, which golfers can use to play better and earn blockchain convertible rewards.

For more information, users can visit GolfN’s: Official Website | Twitter (X) | Discord | YouTube

Contact

James Carney

Operations Lead

GolfN, Inc.

james@golfn.com

+1 708-365-9327

Latest News

Hong Kong Attracts Tech Giants With Favorable Crypto Regulations And Low Taxes | EVM News

The return of blockchain tech companies to Hong Kong reflects growing confidence in its evolving virtual asset market. With robust regulatory frameworks, ambitious government initiatives, and favourable tax policies, Hong Kong is positioning itself as a competitive global centre for virtual assets, attracting investment from around the world.

Since mid-2023, Hong Kong has allowed fully legal crypto trading under specific regulations, setting itself apart from mainland China, where crypto trading has been banned since December 2021. Despite being a special administrative region of China, Hong Kong has taken a favourable stance towards cryptocurrencies.

In the last 12 months, a significant number of Crypto & blockchain technology companies have returned to Hong Kong, indicating growing confidence in the future development of its virtual asset market.

As Hong Kong approaches the 27th anniversary of its return to China, the financial industry in the Special Administrative Region (SAR) is experiencing rapid growth. The SAR government has set ambitious goals, proposing to establish Hong Kong as a global hub for virtual assets. This initiative has led to an influx of digital economy conferences, attracting numerous leaders from the crypto industry to Hong Kong.

One key factor contributing to Hong Kong’s attractiveness is its regulatory environment. Over the past year, the SAR government has implemented rigorous rules for supervising licensed platforms for crypto companies. These regulations have significantly enhanced global investor confidence in Hong Kong’s virtual asset market. As a result, many talented individuals and technology companies have chosen to return to Hong Kong for growth.

The consensus within the Crypto industry is that Hong Kong’s advantages in fostering the virtual asset market are becoming increasingly evident.

Some experts noted that a critical aspect of Hong Kong’s appeal lies in its tax policies. Unlike countries such as Japan and Australia, where investments in cryptocurrencies are subject to asset appreciation taxes that can reach rates as high as 50% and 40% respectively, Hong Kong imposes no such taxes.

A favourable tax regime is particularly attractive to international investors seeking to maximise their investment returns. By offering a low-tax environment for virtual asset investments, Hong Kong is poised to attract more global capital and strengthen its position as a leading hub for the virtual asset industry.

Read also: Binance Scores Partial Victory as Judge Dismisses Some SEC Charges

Latest News

SEC Sues Consensys Over MetaMask, Alleges Securities Violations | EVM News

The SEC has sued Consensys, alleging that its digital asset wallet MetaMask engaged in illegal securities sales and acted as an unregistered broker.

ConsenSys is a popular blockchain software company known for developing technologies like MetaMask. It focuses on decentralised applications & tools around the Ethereum blockchain ecosystem.

On 28 June 2024, The United States Securities and Exchange Commission (SEC) filed a lawsuit against Consensys in federal court in Brooklyn, New York.

The SEC body alleged that Consensys, known for its blockchain software for the Ethereum blockchain, illegally sold unregistered securities and acted as an unregistered broker through its Crypto wallet, MetaMask.

According to the SEC’s allegations, the ConsenSys firm generated $250 million in revenue with the unregistered securities trading services.

Earlier this year, Consensys tried to challenge the SEC preemptively by filing its lawsuit in Texas. They argued that the SEC was overstepping its authority. Consensys took this action after receiving three subpoenas last year and a Wells notice from the SEC, which warned that Consensys was violating federal securities laws.

SEC vs legal hurdles

Many legal experts noted that the SEC body overstepped its authority & tried regulating the crypto sector via enforcement & also pressured the crypto companies to follow traditional financial rules, which are not even applicable to cryptocurrencies.

Recently Coinbase crypto exchange’s legal team filed a suit against the SEC & FEDIC body to get clarity on which rules or laws are used by the SEC body to regulate the sector.

In a recent development, the Supreme Court determined that the Chevron deference, a longstanding judicial doctrine granting federal agencies deference if their interpretations of federal regulations were deemed “reasonable” and if Congress had not explicitly addressed those regulations, is no longer considered a valid standard for regulatory agencies.

Many experts noted that the Supreme Court’s decision to invalidate the Chevron deference could create a more favourable environment for crypto companies. This is because there are currently unclear rules for the crypto sector, and regulatory agencies cannot enforce actions based on old rules that do not clearly define the nature of crypto assets.

Read also: Binance Scores Partial Victory as Judge Dismisses Some SEC Charges

Latest News

Denmark Country Plans To Ban Some Bitcoin & Defi Wallets | EVM News

Denmark has proposed new regulations that might ban the use of self-custody Bitcoin wallets and other decentralised finance (DeFi) platforms.

Denmark, a Nordic country known for its high standard of living, allows the legal trading, buying, and selling of cryptocurrencies. The Danish Financial Supervisory Authority oversees cryptocurrency activities to ensure compliance with financial regulations and prevent money laundering. Recent proposals suggest Denmark may be planning to bring more strict rules & laws to regulate the unregulated part of this innovative sector.

Denmark’s latest approved regulatory proposal could ban self-custody Bitcoin wallets and other DeFi interfaces, decentralised Cryptocurrency protocols.

The Danish Financial Supervisory Authority (DFSA) plans to ban all unregulated wallets due to concerns about unregulated cryptocurrency activities. Despite criticism, the DFSA argues this move will ensure crypto transactions are regulated and address a coverage gap in DeFi regulation.

If this rule is implemented, it will contradict the EU’s Markets in Crypto Assets (MiCA) guidelines and the US’s stance on BTC self-custody wallets. MiCA regulations, effective from December 30, 2024, do not apply to the DeFi sector and have been criticised for stifling innovation but there are huge chances that lawmakers will work later on this issue, probably in 2025.

Estonia & self-custody wallet ban

Estonia, another European Union (EU) member country, has implemented similar rules on self-custodial wallets, which could negatively impact the sector in Denmark.

Crypto enthusiasts noted that if Denmark adopts these rules, no one will be able to offer Bitcoin wallets, DEX interfaces, or any token-related services without being regulated in Denmark’s jurisdiction & there are huge chances that similar measures will be adopted by other EU member countries.

In contrast, the US crypto infrastructure bill FIT21 Act has chosen to study DeFi, like MiCA, instead of regulating it. The DFSA is now seeking feedback from stakeholders on its proposals. That means, the American regulatory body decided to first study this unregulated sector, instead of direct ban/unban decision.

Read also: VanEck Files for SOL Spot ETF with SEC; Technical Indicators Point to Potential $200 Breakout”

-

Latest News3 months ago

Latest News3 months agoCrypto New Media Decrypt Warns Against $Decrypt Token Airdrop Scam | EVM News

-

Latest News4 months ago

Latest News4 months agoCeτi AI Announces Successful Launch Of Revolutionary Decentralized AI Infrastructure Token | EVM News

-

Hot Projects4 months ago

Fetch AI Outshines in AI Token Dominated Gainers but This New AI A… | EVM News

-

Latest News4 months ago

Latest News4 months agoBitcoin Dogs Sets A New Standard In Crypto Amidst Bitcoin Surge | EVM News

-

Latest News3 months ago

Latest News3 months agoJapanese Telecom Companies Jump Into Crypto Sector, Plans To Launch Crypto Wallet | EVM News

-

Latest News2 months ago

Latest News2 months agoBC.GAME Secures New Curacao LOK License, Enhancing Legal Compliance And Global Reach | EVM News

-

Latest News1 month ago

Latest News1 month agoTelegram Founder Receives Donations In Notcoin Worth $7 Million, Rising Appeal For New Memecoin | EVM News

-

Hot Projects1 month ago

Hot Projects1 month agoDogecoin is Severely Underperforming New Memecoins This Year — Sho… | EVM News